8 Gene Editing/CRISPR Companies to Consider For Your Portfolio

Ten years ago, Jennifer Doudna and her colleagues published the results of a test-tube experiment on bacterial genes in the journal "Science". This paper was the beginning of an adventurous journey that led to the development of CRISPR technology.

In the past decade, CRISPR has become one of the most celebrated inventions in modern biology. The technology is now being exploited to develop new therapeutics, diagnostics, edit crops, and much more.

Let's get you up to speed on two technologies, CRISPR and Base Editing (an improvement to first-generation CRISPR technology), before we look at 8 CRISPR-related biotech companies forging the future of medicine.

What is CRISPR?

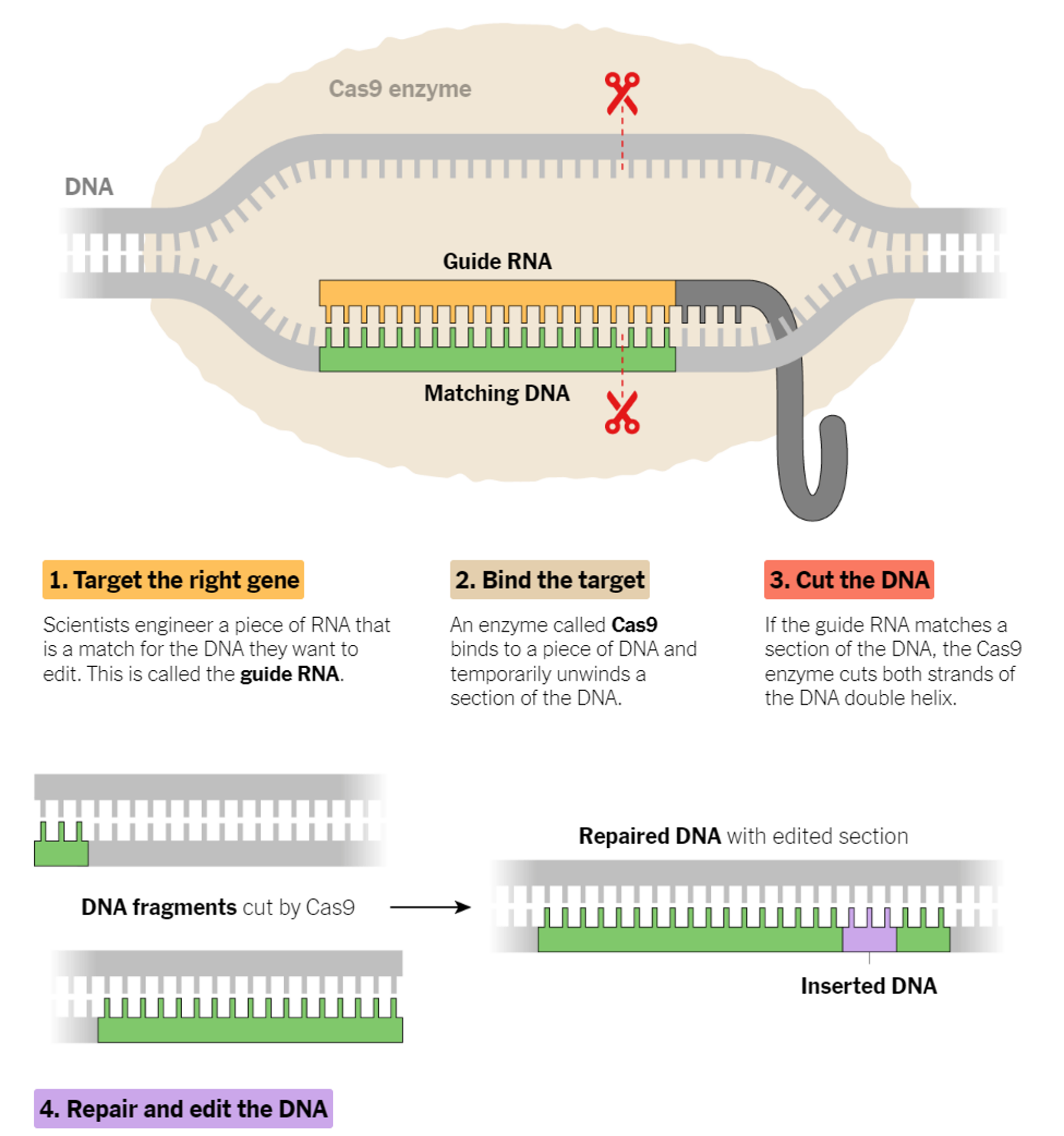

CRISPR stands for Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR). CRISPR-Cas9 was adapted from a naturally occurring genome editing system that bacteria use as an immune defense. When infected with viruses, bacteria capture small pieces of the viruses' DNA and insert them into their own DNA in a particular pattern to create segments known as CRISPR arrays to be ready in case of reinfection.

Why is it important?

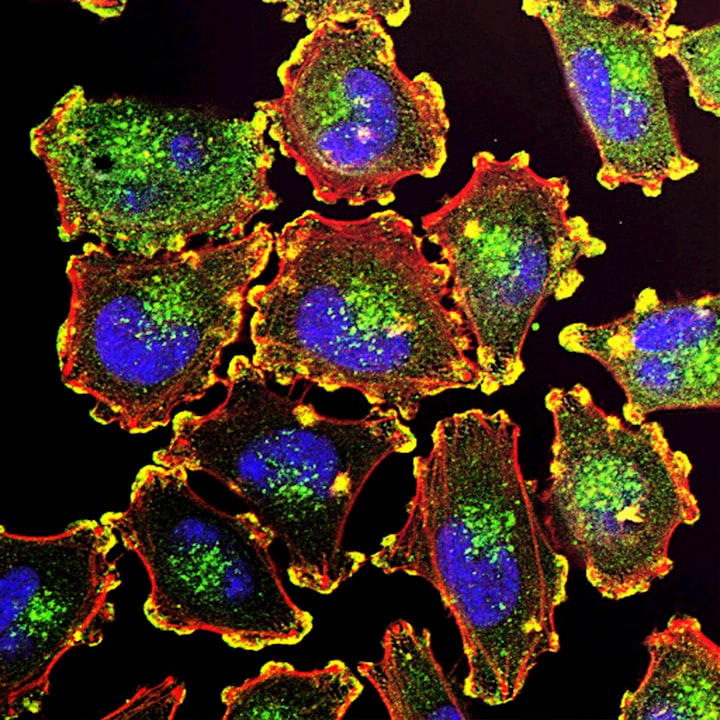

Learning from the nature, researchers utilize CRISPR as a technology that can edit genes at precise DNA location, like a genetic scissors. It allows you to find a specific bit of DNA inside a cell, and using the CRISPR technology you can alter the sequence for various purposes.

It is swiftly changing how medical researchers study diseases: Cancer biologists are using the method to discover hidden vulnerabilities of tumor cells. Doctors are using CRISPR to edit genes that cause hereditary diseases.

It is so revolutionary that in 2020, Emmanuelle Charpentier and Jennifer Doudna were awarded the Nobel Prize in Chemistry for their groundbreaking work on CRISPR technology.

Base editing

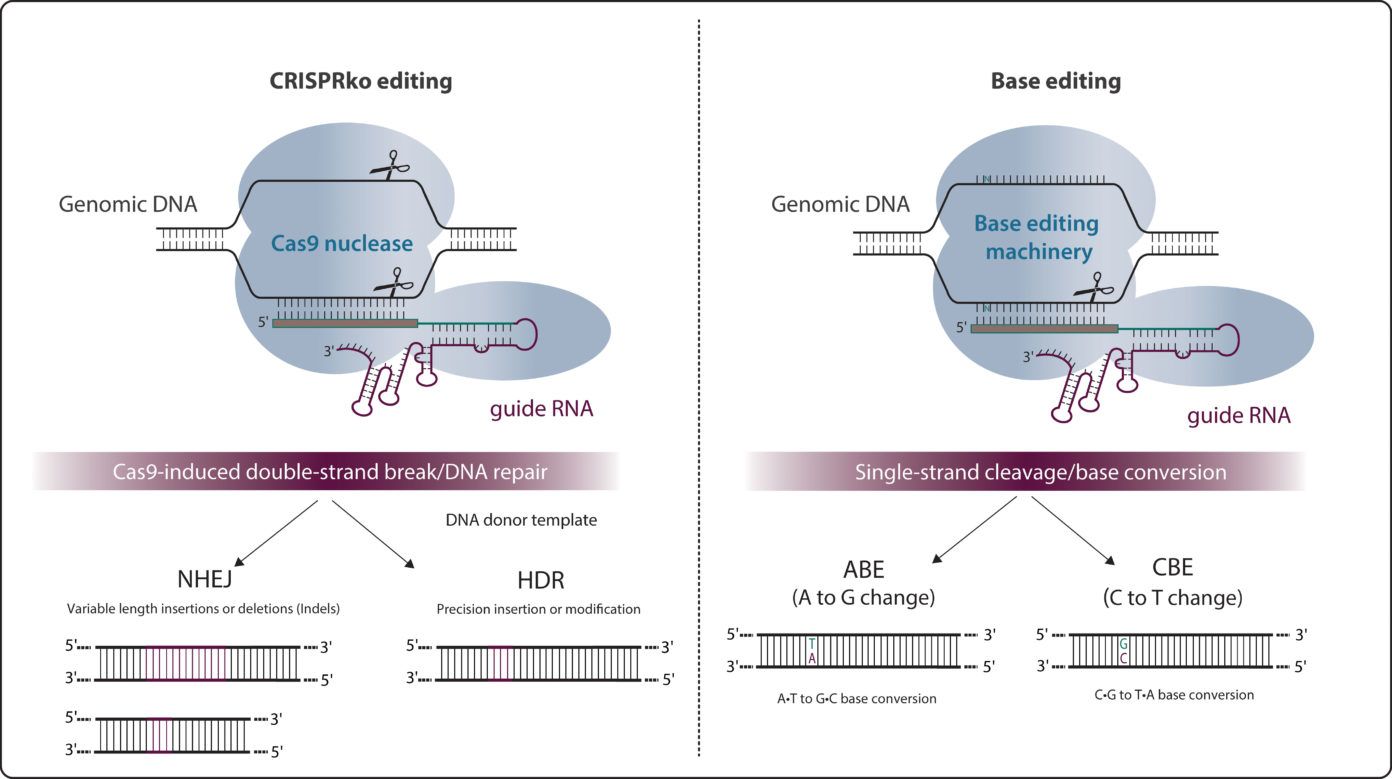

Base editing is a CRISPR-Cas9-based genome editing technology that allows the introduction of point mutations in the DNA without generating double-stranded breaks (DSBs).

Two major classes of base editors have been developed: cytidine base editors or CBEs allowing C>T conversions and adenine base editors or ABEs allowing A>G conversions. Base editors are larger than the standard CRISPR-Cas9 machinery.

As around half of known pathogenic genetic variants are due to single-nucleotide variants (SNVs), base editing holds great potential for the treatment of numerous genetic diseases, through either temporary RNA or permanent DNA base alterations.

8 CRIPSR Stocks to consider

CRISPR gene-editing stocks are not for the faint hearted. These stocks tend to be highly risky and volatile. But for aggressive investors who aren't risk-averse, here are eight of the best CRISPR stocks to consider.

Intellia Therapeutics (NTLA)

Intellia Therapeutics was founded in 2014. Intellia is differentiating itself from its competitors through its two lead assets NTLA-2001 and NTLA-2002, focusing on Transthyretin (ATTR) Amyloidosis and Hereditary Angioedema respectively.

For the former, the drugmaker has partnered up with Regeneron for development. In February 2022, the duo reported positive results for NTLA-2001 in Phase 1 clinical trials achieving between 86-93% reduction in serum TTR at day 28 depending on dosing. This was also the first trial to show that editing of genes within the body (in-vivo method) is possible.

In addition, the therapy was the first of its kind to demonstrate the potential for NTLA-2001, a one-time systemically delivered CRISPR therapy to not only halt but reverse the complications of ATTR amyloidosis.

For NTLA-2002, which is targeting Hereditary Angioedema It is still early days. The company dosed the first patient in a phase1/2 trial in December 2021.

Apart from NTLA-2001 and NTLA-2002, the pipeline includes two other clinical programs:

- Intellia has partnered up with Novartis for the development of OTQ923/HIX763 in treating sickle cell disease.

- The company is also evaluating the potential of NTLA-5001 in a Phase 1/2a study for the treatment of acute myeloid leukemia

Apart from the four assets that Intellia has in clinical trials, the company has another 11 programs in early-stage development. These are either developed independently or with partners Regeneron, Novartis, or VenCell. This gives Intellia a strong pipeline of assets to develop in the future.

The positive data for NTLA2001 is a huge plus for the company compared to its competitors who are still in the early stages of development or struggling to show efficacy in clinical trials. This positive momentum for Intellia would explain its slightly higher market cap compared it its competitors.

Beam Therapeutics (BEAM)

Beam Therapeutics' is the pioneer in the use of base-editing to rewrite the genome. A quick overview of the technology is above. The main advantage of this technology is its ability to rewrite a single letter of the genome with high precision and accuracy.

The drugmaker has eleven novel therapies under development. Most of these programs are in preclinical development, targeting beta-thalassemia, leukemia, and other genetic diseases. The most advanced asset BEAM-101 is currently in phase 1/2 clinical trials for the treatment of SCD.

Like CRISPR Therapeutics, Beam has partnerships with Pfizer and Apellis. The Pfizer collaboration is especially lucrative, with Beam receiving US$300M in upfront fees with potential milestone payments of up to US$1B. It also has the option to opt-in to co-develop and co-commercialize one program with Pfizer.

Despite having an early development pipeline, the company's market cap isn't far below the levels of other CRISPR stocks with much more advanced pipelines. This is likely because it is estimated that there are 5000-8000 monogenic diseases (single-letter changes in the genome) for which base-editing is probably the preferred technology for treatment. The large addressable market and the long-term potential for Beam's technology could thus justify this premium valuation.

CRISPR Therapeutics (CRSP)

CRISPR Therapeutics started in 2013 and is headquartered in Zug, Switzerland. The company has a portfolio of therapeutic programs across a range of disease areas. These including hemoglobinopathies, oncology, regenerative medicine, and rare diseases.

CRISPR Therapeutics has five therapies in clinical trials. For CTX001, it has partnered up with Vertex Pharmaceuticals (NASDAQ: VRTX). For this asset, the company reported positive interim data in June 2022. All 75 treated patients with either transfusion-dependent beta-thalassemia (TDT) or severe sickle cell disease (SCD) showed zero or reduced need for blood transfusions. This is a significant improvement compared to current available treatment options. The two companies hope to gain regulatory approval for this asset in late 2022.

Apart from TDT/SCD, the drugmaker is evaluating three allogenic CRISPR gene-edited CAR-T therapies (CTX110 – CD19+ B Cell malignancies, CTX120 – multiple myeloma, CTX130 for solid tumors and blood cancer) which are in phase 1 clinical trials. It also has a phase 1 study ongoing for the treatment of type 1 diabetes with its partner ViaCyte. *ViaCyte was acquired by Vertex just 2 days before we published this article, you can read more here.

The company has four preclinical assets in its pipeline, targeting rare genetic diseases. It is exploring an in-vivo treatment methodology for these assets. This would change its current treatment workflow which involves in-vitro editing before infusion into the patient. This change would be a step forward in medicine.

As we are still early in the CRISPR journey, all CRISPR-related stocks are risky. CRISPR Therapeutics with its strong cash position and partnership with Vertex is well positioned in our opinion. We believe it has the necessary firepower to see it through the development of its most advanced assets. Additionally, positive results from its CTX001 asset should provide investors with some comfort.

Investors however, should track the recent IP ruling on ownership of the CRISPR-Cas9 editing technology. From our understanding the decision is likely unfavorable to CRISPR Therapeutics based on this article. As such, we are still uncertain about potential IP issues the company might face moving ahead and how it might affect the commercialization of its assets.

Editas Medicine (EDIT)

Editas Medicine is the next CRISPR- focused biotech on the list. Editas is differentiating itself from its competition by exploiting CRISPR to treat rare genetic eye diseases.

On the technology front, Editas can use both the Cas9 and Cas12 editing technologies. It has developed the SLEEK platform which utilizes the Cas12 nuclease. The Cas12 nuclease creates a double-strand cut in a staggered pattern as opposed to a blunt end cut seen with the Cas9 nuclease. While this might seem trivial but staggered cuts are preferred as it allows for higher precision during the repair process. Also, the Cas12 nuclease requires only one guide RNA providing manufacturing advantages.

Editas currently has 10 programs in the pipeline at various stages of development. The drugmaker reported preliminary phase 1/2 study results for EDIT-101 in September 2021 evaluating its efficacy in treating Leber congenital amaurosis 10 (LCA10). The results failed to impress investors as the stock was aggressively sold down post announcement. Editas is continuing with the trial and it remains to be seen if the therapy results in improved outcomes at a later date.

Another clinical-stage candidate is EDIT-301 which targets SCD/TDT. The drugmaker utilized its SLEEK platform for this therapeutic. The HBG1/2 promotor regions in hemopoietic stem cells (HSCs) are edited using the SLEEK platform which reduces BCL11A repression, thus increasing fetal hemoglobin production. The treatment method used by Editas is different compared to CRISPR Therapeutics and BEAM which are directly editing the BCL11A gene.

Apart from the EDIT-101 and EDIT-301 assets, the rest of the pipeline programs are still in the early stages of development. Editas has been closely followed by CRISPR-focused investors due to it being one of the pioneers in the field. However, the mixed results from its EDIT-101 trial seem to have put a dampener on its standing among investors which is evident from its current market capitalization which is smaller than rivals such as CRISPR Therapeutics, BEAM, and Intellia.

Graphite Bio (GRPH)

Graphite Bio was incorporated in 2017 and previously known as Integral Medicines. Graphite Bio is a clinical-stage gene editing company. It is engaged in the development of therapies utilizing homology directed repair (HDR). The company believes this method has the potential to cure a wide range of disorders and is initially focusing on development a therapy for sickle cell disease (SCD).

The lead product, GPH101, works by gene-editing HSC to correct the mutation that causes sickle cell disease (A to T change in the beta globulin gene) and thereby restore normal adult hemoglobin expression. This method of therapy is different compared to CRISPR Theraputics, Beam, Editas and Intellia who are working to upregulated fetal hemoglobin production.

Graphite has three other programs that are currently in IND-enabling (preclinical) studies:

- GPH201 for the treatment of X-linked severe combined immunodeficiency syndrome;

- GPH301 for the treatment of Gaucher disease, a genetic disorder that results in a deficiency in the glucocerebrosidase enzyme;

- An undisclosed non-genotoxic HSC targeted conditioning (NGTC) regimen.

Compared to other gene editing companies covered in this article, Graphite is quite young and currently only has one product in early-stage clinical trial. The small number of pipeline programs, together with the lack a large pharma partnership could explain its small market cap which currently stands at under US$200M.

Caribou Biosciences (CRBU)

Caribou Biosciences is a clinical-stage biopharmaceutical company incorporated in 2011. The company is utilizing CRISPR technology to gene-edit allogeneic T cells for the development of cell therapies. The drugmaker's focus is on the treatment of hematologic malignancies and solid tumors.

The company’s lead asset is a convenient, “off-the-shelf” alternative to personalized CAR-T therapy. CB-010, an allogeneic anti-CD19 CAR-T cell therapy is currently being evaluated in phase 1 clinical trial to treat relapsed or refractory B cell non-Hodgkin lymphoma.

Caribou has 3 other assets in its pipeline:

- CB-011, an allogeneic anti-BCMA CAR-T cell therapy for the treatment of relapsed or refractory multiple myeloma is in IND stage development.

- CB-012, an allogeneic anti-CD371 CAR-T cell therapy for the treatment of relapsed or refractory acute myeloid leukemia; and

- CB-020, an allogeneic CAR-NK cell therapy for the treatment of solid tumors is currently in the discovery stage.

In June 2022, Caribou Biosciences provided an update for an early-stage study involving CB-010. All six non-Hodgkin lymphoma patients who received a low dose of the treatment were initially driven into remission. One patient who received the drug remained cancer-free after 12 months while another remained cancer-free for 6 months. However, three of six patients relapsed, with one seeing the disease progress only after three months. The data can be found here.

Since the report, Caribou shares have been under pressure. The company is still early in its development of therapeutics. This recent setback raises the question of how Caribou will sail through this wave of concern regarding its cell therapies' durability.

Verve Therapeutics (VERV)

Verve Therapeutics is a genetic medicine company focused on treating cardiovascular diseases (CVD). The company is exploiting gene editing to develop therapeutics for CVD by targeting two proteins PCSK9 and ANGPTL3.

Its lead asset is VERVE-101, a single-course gene-editing treatment that permanently turns off the PCSK9 gene in the liver. The treatment would edit the genome of liver cells resulting in a reduction in the clearance of LDLR (Low-Density Lipoprotein Receptor). The reduction of LDLR clearance will allow for the lowering of circulating LDL cholesterol in a person’s bloodstream thereby reducing the risk of a heart attack. In May 2022, Verve announced that it received clearance to initiate a clinical trial for VERVE-101. In July 2022, the company dosed its first patient with this therapy, the article can be found here.

Apart from VERVE-101, the company is engaged in the development of a therapeutic that will permanently turn off the ANGPTL3 gene in the liver. By inhibiting the production of ANGPTL3 reductions in triglycerides and non-high-density lipoprotein cholesterol can be achieved. This would thus reduce the risk of CVD.

As both products in Verve’s pipeline are still in the early stages of development, investors should be cautious as Verve in our opinion is a highly risky investment. But for investors with a strong stomach and patience, the potential returns can be lucrative.

Poseida Therapeutics (PSTX)

Incorporated in 2014, Poseida Therapeutics is a clinical-stage biopharmaceutical company focused on the development of CAR-T and gene therapy products.

The company is developing P-PSMA-101, an autologous chimeric antigen receptor T cell (CAR-T) product candidate that is in Phase I trial for the treatment of patients with metastatic castrate-resistant prostate cancer (mCRPC). This trial faced a setback in May 2020 when one patient in the trial died of liver failure resulting in a clinical hold on the trials.

The clinical hold was subsequently removed in Nov 2020, and the drugmaker resumed the trial. In Feb 2022, the company provided an update in which it mentioned that 7/10 patients saw declines in PSA. The details of the results can be found here for interested investors.

Poseida is also developing two other assets which are in Phase 1 clinical trials:

- P-BCMA-ALLO1 to treat patients with relapsed/refractory multiple myeloma;

- P-MUC1C-ALLO1 for treating a range of solid tumors, including breast, ovarian, and other epithelial-derived cancers.

The drugmaker has another four CAR-T therapies and one gene therapy program in preclinical development. Additionally, it has partnered up with Takeda and has seven gene therapy programs in preclinical development with them.

While Poseida has a large number of programs in its pipeline, its small market cap which currently stands at US$200M is possibly due to the uncertainties about its CAR-T assets and gene therapy assets being in the early stages of development.

If you like our article, please subscribe to our newsletter to receive the latest articles directly in your inbox.

Disclaimer: All opinions shared in this article are the opinions of the authors and do not constitute financial advice or recommendations to buy or sell. Please consult a financial advisor before you make any financial decisions.

Comments ()